A question that arises repeatedly for young families buying their first life insurance policies is, “What is the difference between term and whole life insurance, and which is best for my needs?”

Shopping for life insurance isn’t fun. It’s tough to face your own mortality along with trying to navigate unfamiliar, complicated information. On top of that, most insurance companies don’t make it easy.

There are companies that try to make insurance more complicated in order to reach a wider range of customers. Your Policy, (link to website) on the other hand, works hard to make your experience transparent, easy, and convenient. Our carriers are experts at finding the right insurance to fit your needs and your budget. They understand the different types of life insurance, and they know how to find the perfect policy for you.

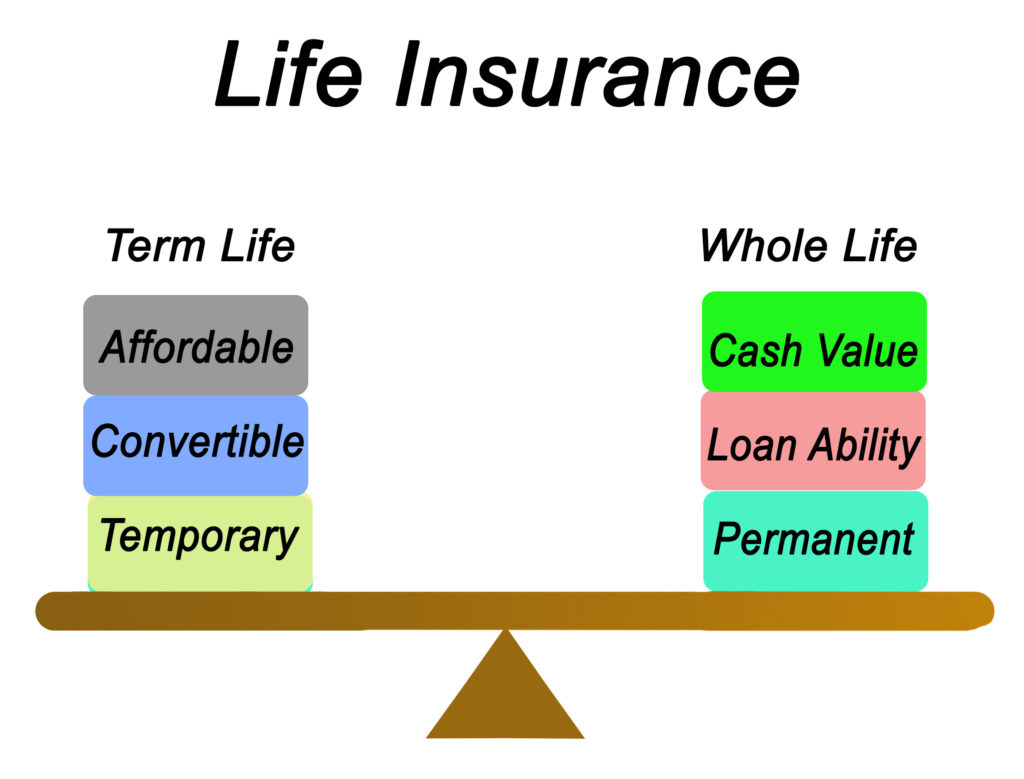

What is the Difference Between Term and Whole Life Insurance

Let’s start with some basic definitions.

Term Insurance

Term life insurance is straightforward and easy to understand. As the name suggests, it is good for a certain period of time (a term). It is simply the promise of a death benefit for your beneficiary. It is much less expensive than whole life, and a good fit for a family that wants a large amount of insurance for relatively small premiums.People who purchase term insurance are mainly concerned about temporary needs like paying off a mortgage or providing money for college. They simply want to give their loved ones financial freedom in the event of their passing.

Whole Life Insurance

Whole life insurance provides a death benefit as long as you keep making your premium payments. There is no set period of time as there is with term insurance. This type of insurance also provides a cash value in addition to a death benefit. It’s more complex than term insurance and far more expensive. Those who purchase whole life insurance are interested in having a cash value component in addition to a death benefit.

Following are some guidelines to help you understand the different types of insurance.

Key Components of Term Insurance

- Term coverage is temporary. It protects you for a limited amount of time (a term to be determined by you) as long as you maintain your premium payments.

- Term insurance tends to be lower in cost than other types of insurance.

- This type of insurance is straightforward and easy to understand.

- Because it eventually expires, term insurance is fundamentally a means to give you peace of mind that your family is protected. It cannot be used to build wealth or as a tax-planning strategy.

Key Components of Whole Life Insurance

- Whole life coverage never expires as long as you keep up with your premium payments.

- This type of insurance is much higher in cost that term insurance, but you can lock in your premiums for life.

- Whole life insurance builds cash value over time. A portion of your premiums becomes part of the policy’s cash value.

- If you choose to, you can take a loan from this policy to pay for expenses like college or home renovation.

- If you do take a loan from this policy, that amount will be deducted from what your beneficiaries receive. For example, if you borrow $50,000 from your policy, the policy will be worth $50,000 less at the time of your passing.

- You can’t just walk away from your policy if you decide that you can’t afford it. Depending on your carrier, you may face a surrender charge that could be up to 10% of your cash value.

- Whole life insurance can be a valuable tool in succession planning for small businesses as part of a buy and sell agreement.

These points can guide you in your decision making process, but choosing coverage can be tricky. For more details and information, talk to a licensed insurance agent as well as your financial advisors.

The Bottom Line

Everyone’s circumstances are unique, and everyone has different needs. Before you make any decisions, speak to a licensed insurance agent with the expertise to understand how different types of insurance fit your needs and your lifestyle. At Your Policy (link to website) we’re here to make the process as painless as possible.

We’ll facilitate the process so that you can make an informed decision. Protecting your loved ones and your assets is important for your peace of mind. Don’t wait another second.