Why Your Boat’s Value Matters More Than You Think

The value of a boat isn’t just a number, it’s the foundation of your insurance coverage. As a boat owner, you’ve likely created years of unforgettable memories, sunset cruises, weekend escapes, or early morning fishing trips. But have you considered how your boat’s insurance value could impact your finances after an accident, storm, or theft?

Understanding how insurance companies determine the value of your boat is essential to protecting your watercraft and getting the most out of your insurance policy.

Boat insurance isn’t one-size-fits-all. Insurers consider many different factors when determining the value of a boat and how much they’ll pay in the event of a loss. That’s why understanding how boat insurance values are calculated is important, not just for peace of mind, but to protect your investment.

So, how is boat insurance calculated? Let’s break it down.

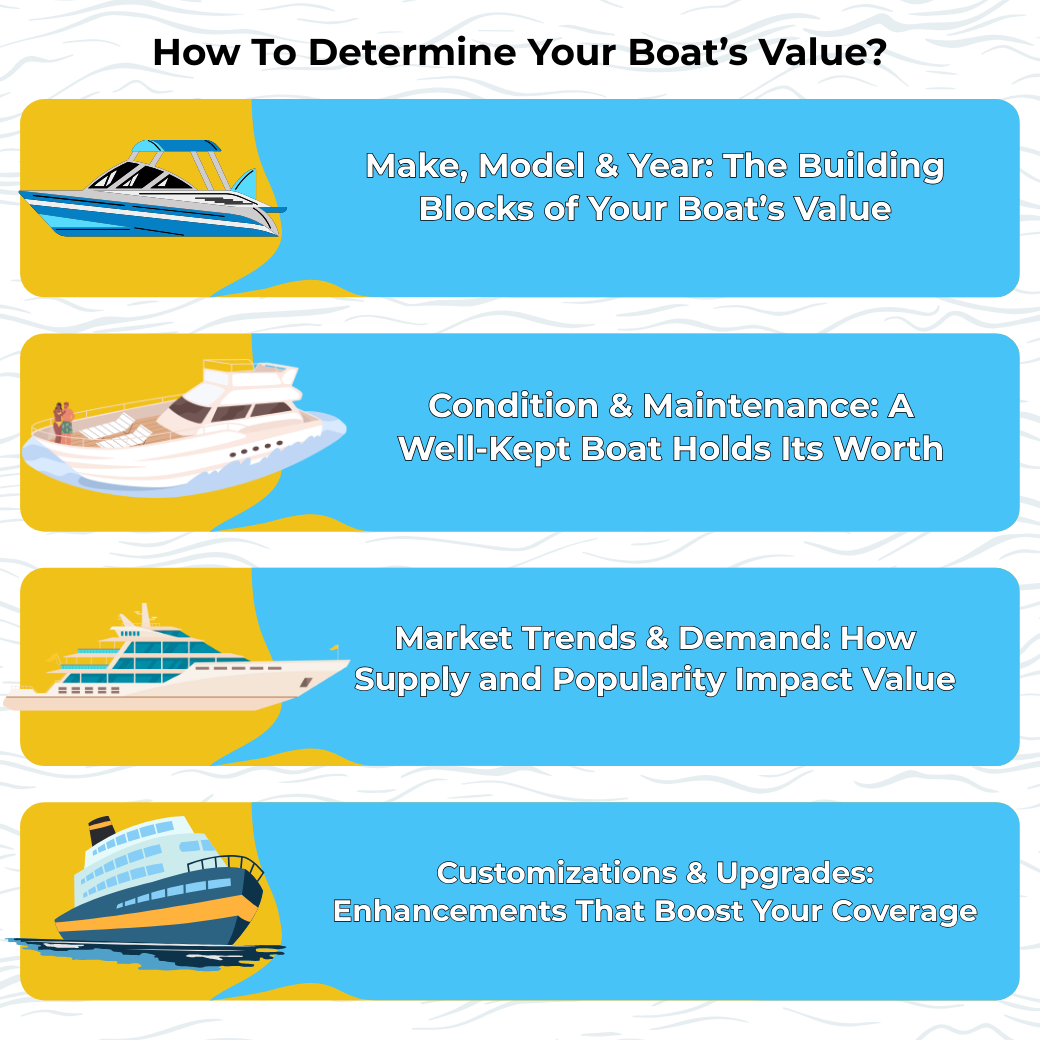

Key Factors That Determine the Value of a Boat

Insurance companies don’t just pick a number out of thin air. They assess several boat insurance coverage factors while determining the value of a boat.

1.Make, Model & Year – The Basics That Shape the Value of a Boat

Just like with cars, a boat’s make, model, and year play a significant role in determining its value. A 2024 Boston Whaler Outrage will have a vastly different boat insurance value than a 1998 Bayliner Capri.

-

Newer boats: Typically insured for higher amounts due to modern technology, safety features, and demand.

-

Older boats: Subject to boat depreciation insurance, meaning their insured value decreases over time.

2. Condition & Maintenance – Crucial to the Value of a Boat

A well-maintained vessel retains more value. Insurers often request a boat appraisal for insurance or maintenance records to assess the value of a boat.

-

Good condition = Higher insured value. Regular servicing and professional inspections can prevent boat depreciation from reducing your coverage too quickly.

-

Poor condition = Lower insured value. If your boat has damage, outdated parts, or engine issues, insurers will factor that into the policy.

3. Customizations & Upgrades – How They Affect the Value of a Boat

Boat values can rise or fall based on supply, demand, and regional trends. If your boat model is highly sought-after, the value of your boat could be higher.

-

Why it matters: Insurers won’t cover upgrades unless they’re accounted for in your policy prior to the claim.

-

Pro tip: Keep receipts, take photos, and update your policy regularly to ensure how upgrades affect boat insurance works in your favor.

4. Market Trends & Demand – External Influences on the Value of a Boat

Boat values can rise or fall based on supply, demand, and regional trends. If your boat model is highly sought-after, the value of your boat could be higher.

5. Agreed Value vs. Actual Cash Value – What Type of Policy Do You Have?

Not all policies are created equal. The way boat insurance is calculated depends on whether you have an agreed value vs actual cash value policy.

-

Agreed Value Policies: You and the insurer decide on a set value at the time of coverage. If your boat is totaled, you get that agreed amount without depreciation.

-

Actual Cash Value Policies: Your payout accounts for depreciation, meaning you may receive less than you expected after a claim.

Want to maximize the value of your boat? Choosing the right policy can make a huge difference in how much you get paid after a loss.

How Insurance Companies Assess Your Boat’s Value

Now that we’ve covered common boat insurance coverage factors, let’s talk about how insurers calculate it.

1. Marine Surveys & Boat Appraisals for Insurance

For high-value boats or older models, insurers may require a boat appraisal for insurance by a certified marine surveyor. This report includes:

-

Structural integrity

-

Engine condition

-

Market value comparison

-

Safety compliance

2.Comparable Sales – How Listings Help Define the Value of a Boat

Like real estate, insurers compare similar boat listings to assess the value of a boat.

3. Depreciation Schedules – Why Age Matters

Most boats lose value over time, which is where boat depreciation insurance comes in. Insurers use standard depreciation rates based on your boat’s age, condition, and market trends.

How to Maximize the Value of a Boat for Insurance

Want to get the best possible boat insurance value? Here’s what you can do:

· Keep records of maintenance and upgrades. Regular servicing prevents unnecessary depreciation.

· Opt for an agreed value policy if possible. It protects against depreciation.

· Get periodic boat appraisals for insurance. This ensures your policy reflects your boat’s actual worth.

· Work with an independent agent. They can help you navigate custom boat insurance valuation and ensure your coverage is tailored to your needs.

Protect Your Investment Before You Hit the Water

The value of a boat isn’t just a number, it’s the key to ensuring you’re properly covered in case of an accident, theft, or storm damage. By understanding how boat insurance is calculated and the key boat insurance coverage factors, you can make smarter decisions and avoid surprises when you file a claim.

At YourPolicy, we specialize in custom boat insurance valuation, helping boat owners secure the best coverage for their unique needs. Ready to review your policy? Contact us today for a thorough review and free quote to make sure your boat is protected before summer hits! Call an expert at 512-265-1744, we’d love to help!

Frequently Asked Questions About Boat Insurance Value and Coverage

How is boat insurance calculated?

Insurance companies calculate boat insurance value based on several factors, including the boat’s make, model, year, condition, upgrades, and market demand. They also consider whether the policy is based on agreed value vs actual cash value, which impacts how much you’ll receive in a claim.

What factors determine the value of my boat for insurance?

The value of my boat is determined by boat insurance coverage factors such as age, maintenance history, custom upgrades, depreciation rates, and recent sales of similar boats. A boat appraisal for insurance may also be required for older or high-value vessels.

Does boat insurance cover depreciation?

Yes, but it depends on your policy. Boat depreciation insurance applies if you have an actual cash value policy, meaning your payout will account for wear and tear. However, an agreed value policy locks in a set payout amount without depreciation.

How do upgrades affect boat insurance?

How upgrades affect boat insurance depends on the modifications you make. High-end electronics, custom interiors, and engine enhancements can increase the value of my boat, but only if they’re documented and added to your policy.

How do I get a custom boat insurance valuation?

A custom boat insurance valuation can be obtained through a marine surveyor or professional boat appraisal for insurance. This ensures your coverage reflects your boat’s actual worth, including custom features and market value.

Is an agreed value policy better for high-value boats?

For high-end boats, an agreed value vs actual cash value policy decision is crucial. Agreed value policies offer better protection by covering the full insured amount, while actual cash value policies deduct for depreciation. Owners of high-value boats often prefer agreed value coverage for maximum payout security.