Why Your Gear Deserves More Than Just a Lock: A Guide to Adventure Van Insurance

If you’ve invested in an adventure van, you’ve invested in a lifestyle that can make you a target. Whether it’s a tricked-out mountain bike, rooftop solar setup, or high-end drone, your gear isn’t just stuff, it’s part of how you live and explore. Bungee cords and locks won’t cut it when it comes to real protection from thieves! What you need is adventure van insurance that’s built for the road ahead.

What Is Adventure Van Insurance—and Why You Need It

Adventure van insurance is specialized coverage that goes beyond standard auto policies. It protects the high-value gear inside your van, including bikes, boards, batteries, and cameras, plus the van itself.

Most people assume their auto policy has them covered. But in reality, standard car insurance usually won’t protect your gear from theft, loss, or damage. That’s where tailored adventure van insurance comes in.

What Counts as “Adventure Gear” in Your Van?

When building the right campervan policy, it helps to know what gear insurers consider “high value.” Most policies can protect:

-

Mountain bikes and e-bikes

-

Paddleboards, surfboards, and snowboards

-

Portable solar panels and lithium battery setups

-

Drone and camera gear

-

Cooking and camping gear

-

Rock climbing, kayaking, and fly-fishing equipment

Campervan gear can add up fast, often to $10,000 or more. That’s why skipping proper adventure van insurance isn’t worth the risk.

Why Auto Insurance Isn’t Enough for Van Life

Auto insurance is designed to protect your vehicle, not your lifestyle.

Typical coverage includes:

-

Liability

-

Collision

-

Comprehensive (sometimes)

But here’s the catch: your gear is usually excluded unless it’s permanently attached to the van. Even comprehensive policies generally don’t cover personal belongings, especially expensive, portable equipment. That’s why real campervan insurance goes much further.

Types of Adventure Van Insurance Coverage You Should Consider

Building the right policy starts with combining layers of protection. Here’s what smart van lifers use to protect their gear and their freedom.

Comprehensive Auto Insurance

Good for damage to the van—like vandalism, theft, or fire. But it won’t protect loose gear unless you add more coverage.

RV Insurance (for Vans with Permanent Builds)

If your van has a fixed bed, sink, or kitchenette, it may qualify as an RV. RV adventure van coverage often includes personal belongings and even liability while parked.

Personal Articles Policy (also called Inland Marine)

Perfect for covering high-ticket gear, like drones, camera equipment, bikes, or instruments. These policies follow the item, not the van.

Home or Renters Insurance Extension

If your van isn’t your full-time residence, your home policy might offer some coverage. But limits are often low, and claims can affect your homeowners rate.

Add-Ons That Take Your Adventure Further

Once you’ve got your main coverage in place, consider these add-ons that make adventure van insurance truly road-ready:

Theft Coverage

Theft Coverage

Whether you’re parked in a national park or a downtown parking lot, gear theft is a real threat. Worldmetrics.org estimates that 17,000 RVs are stolen annually in the United States, and adventure vans can be prime targets. Choose a policy that covers stolen gear, not just vehicle theft. Without the right protection, you could be out thousands in gear and repairs.

Liability Insurance

If someone gets injured around your van (say, tripping on your awning), personal liability can protect you from major legal headaches.

Roadside Assistance

Breakdowns happen. Whether you’re 5 miles from a trailhead or 50 miles from the nearest gas station, roadside coverage can be a trip-saver.

Do You Need Custom Adventure Van Insurance?

Probably. And here’s why:

-

Every adventure van is built differently

-

Every traveler has unique gear

-

Coverage needs vary based on where, when, and how you travel

An e-bike used for weekend rides in Oregon needs different protection than a drone used for professional videography in Arizona. With customized adventure van insurance, you get exactly what you need without overpaying.

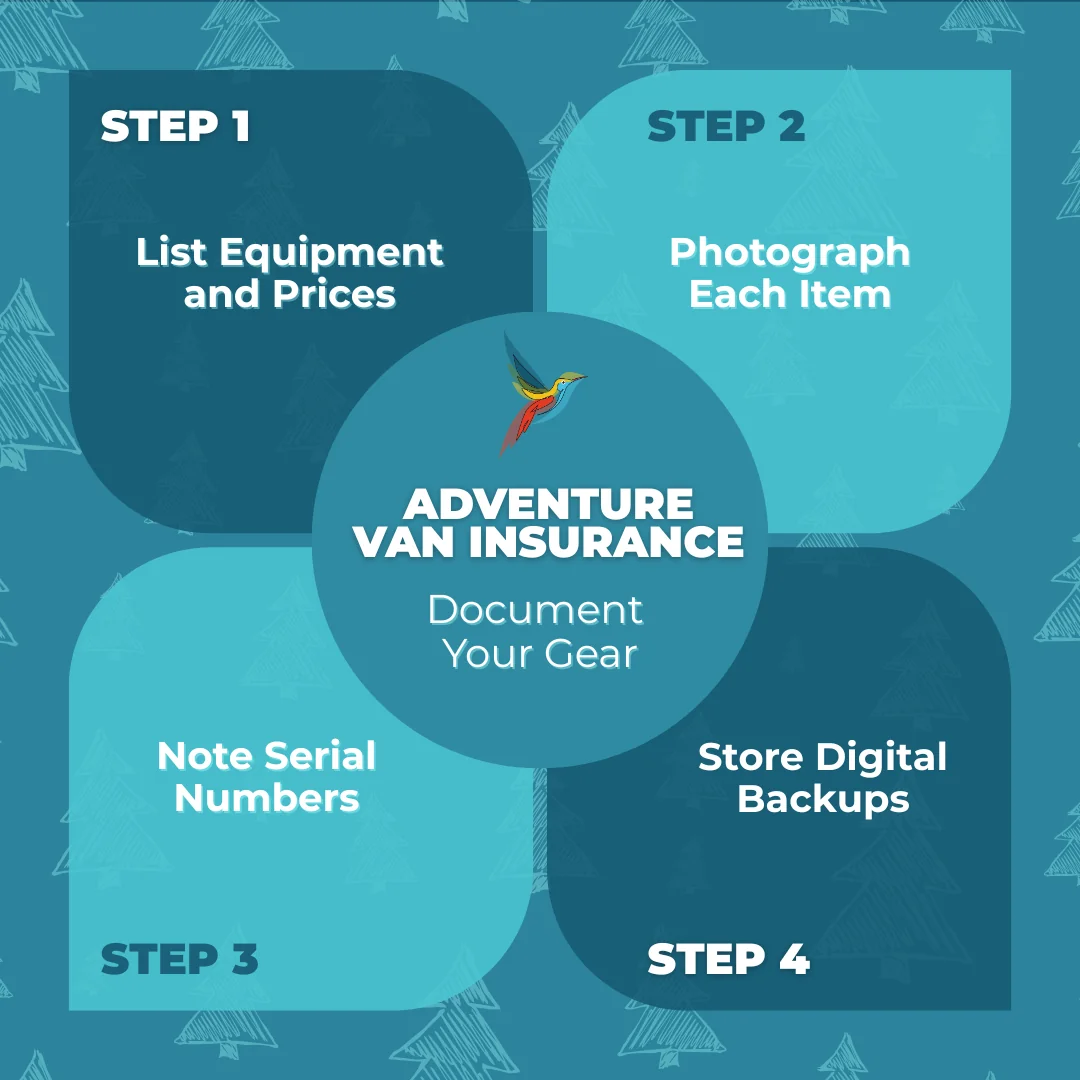

What to Do After You Purchase Adventure Van Insurance

Getting adventure van insurance is a huge step in protecting your beloved gear, but the job doesn’t stop there. To ensure a smooth claims process and maximize your coverage, take these four smart steps right after you secure your policy:

1. List All Equipment

Create a detailed inventory of the gear in your adventure van. Include everything of value, like bikes, solar setups, drones, cooking gear, and electronics. This helps you identify exactly what’s covered and makes filing a claim much easier if something goes wrong.

2. Photograph Each Item

Take clear, high-quality photos of every item you’ve listed. Capture each item from multiple angles, including any unique features or customization. These images serve as proof of ownership and condition.

3. Note Serial Numbers

Record serial numbers, brand names, and models for each item. This information can help insurers validate claims and may even assist in recovering stolen gear.

4. Store a Digital Backup

Save all this information—photos, lists, receipts, and serial numbers—in a secure cloud-based storage system. That way, even if your laptop or van is stolen, you’ll still have everything you need to file a claim quickly.

Share Your Inventory with Your Agent

Your independent insurance agent can keep a copy on file and alert you to any coverage gaps based on your gear list. That’s just one more reason why choosing an independent agency for your adventure van insurance makes all the difference.

Go Far, But Cover Smart with Adventure Van Insurance

Van life is freedom, flexibility, and the open road, but without the right adventure van insurance, that freedom is vulnerable.

Imagine your solar setup fries in a lightning storm. Or your bikes are stolen outside a trailhead. Don’t wait until disaster strikes to find out what’s not covered.

With the right adventure van insurance, you’re free to roam, create, explore and worry a whole lot less.

Quick Takeaways: Why Adventure Van Insurance Matters

-

Most auto policies don’t cover your gear

-

Consider RV insurance, personal articles, or both

-

Customize based on travel habits and van features

-

Work with an independent agent for best value

-

The right adventure van insurance lets you travel smarter

Adventure Van Insurance Review

Get a Free Adventure Van Insurance Review & Quote Today

Your gear works hard! You should have a policy that works harder. As an independent insurance agency, we offer more than just adventure van insurance. We offer peace of mind. Unlike captive agents who represent just one company, we shop multiple carriers to find the right fit for your lifestyle, your gear, and your budget. And if you ever have to file a claim, we’re here to help you navigate the process.

Call us today at 512-265-1744 or reach out through our online contact form to get started!

YourPolicy Insurance Agency Locations

We’re licensed to provide insurance services in all 50 U.S. states! You can currently visit us in person at our offices in Texas, Washington, Virginia, Montana, North Dakota, Massachusetts, Kentucky, Colorado, Oregon, Michigan, and Louisiana.

YourPolicy is rapidly expanding! If your state isn’t listed yet, check our agency locations to see if we’ve expanded near you. Prefer to connect remotely? You can always give us a call or fill out our online form. We look forward to serving you!