Is Your Insurance Keeping Up With Life?

As you go through life changes, are you regularly performing an insurance coverage review to ensure your assets remain covered? If not, you may be in for a big surprise.

Imagine completing a major home renovation—adding a deck and updating your roof—only for a severe storm to strike just as you’re starting to enjoy your upgraded space. Unfortunately, since you didn’t update your home insurance after the renovations, your policy doesn’t fully cover the repair costs, leaving you to cover the difference. You’re suddenly back to square one.

In fact, according to Bankrate, wind and hail accounted for nearly 40% of home insurance claims in 2022. While wind and hail are beyond our control, ensuring your coverage is up to date isn’t. Regularly reviewing and updating your policy can help you avoid costly surprises when the unexpected happens.

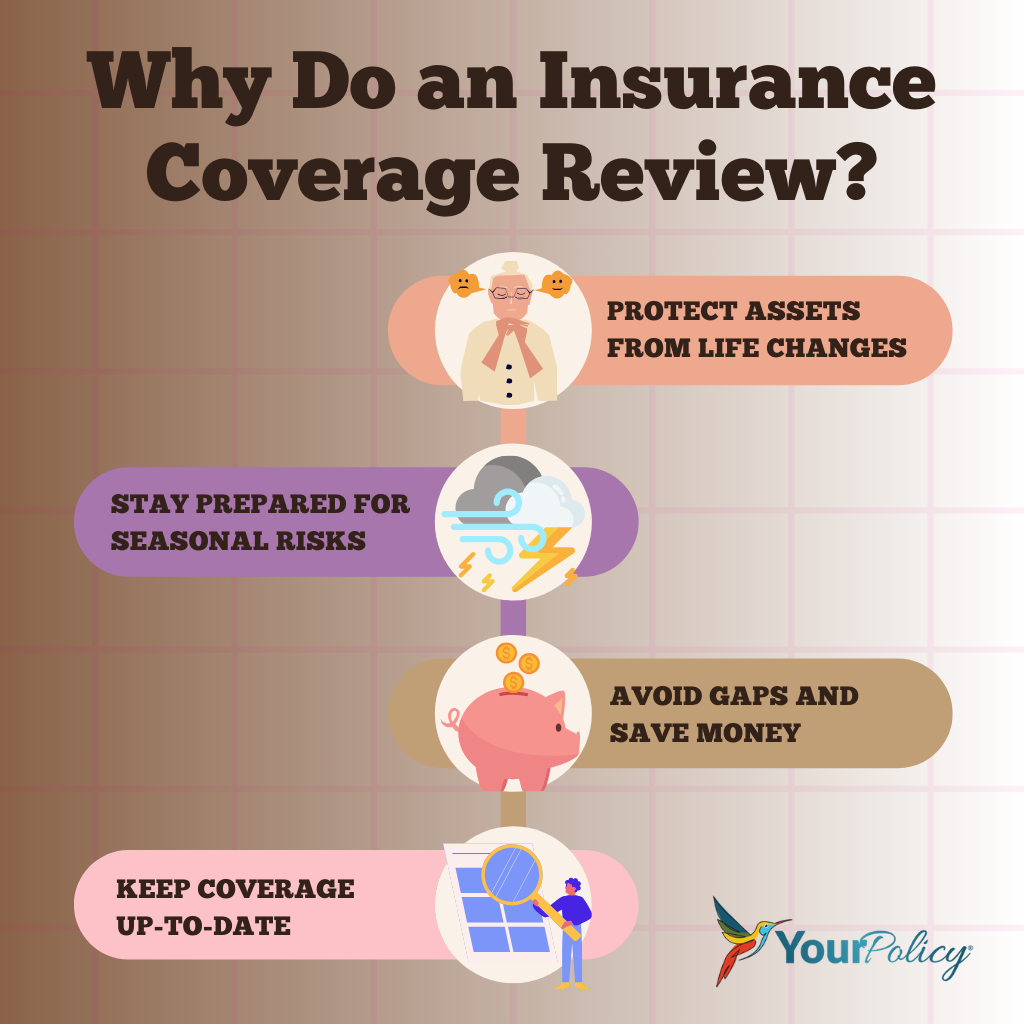

Why You Should Do an Insurance Coverage Review

An insurance coverage review is essential to maintain adequate protection. Here are the top reasons to review your insurance annually:

1. Life Changes That Affect Your Coverage

- Home Renovations: Did you recently add a deck, remodel your kitchen, or install solar panels? These changes can increase your home’s value, meaning your current policy might not cover the replacement cost.

- New Drivers in the Family: Adding a teen driver to your auto insurance policy significantly impacts your premiums and coverage needs.

- Major Purchases: From a new car to expensive electronics or jewelry, these items may require policy updates.

2. Seasonal Risks You Might Not Have Considered

Different seasons bring unique risks. For example:

- Winter: Burst pipes, roof collapses from heavy snow, and icy roads leading to car accidents.

- Spring: Flooding, wind damage, and increased traffic accidents from rainy weather.

- Summer: Hailstorms, wildfires, and risks associated with road trips.

- Fall: Fire hazards from heating systems and falling tree limbs during storms.

Proactively updating your policies ensures you’re ready for any weather-related surprises. This is why seasonal insurance updates are key to staying protected year-round.

3. Save Money and Avoid Surprises

Did you know that outdated policies can sometimes lead to overpaying? A thorough insurance coverage review helps you:

- Identify redundant coverage.

- Take advantage of new discounts for bundling home and auto policies.

- Avoid costly gaps in protection.

When to Do a Coverage Review

If you’re wondering when to do a coverage review, here are some critical times to consider:

Annually or Semi-Annually

An annual review is a great habit to ensure your policies stay current. Consider adding it to your New Year’s resolution list or doing a check-in during tax season when finances are already top of mind.

After Major Life Events

Some events that should trigger a insurance coverage review include:

- Marriage or Divorce: Update beneficiaries, and adjust liability coverage.

- Moving: Whether it’s buying a new home or renting, your location impacts your risk factors and premiums.

- New Job: If you’ve started working from home, you might need additional coverage for home office equipment.

Before Major Weather Seasons

Plan seasonal insurance updates ahead of time! You’ll want to be especially thorough before hurricane season, winter storms, or when wildfire risks ramp up.

How to Review Insurance Policies Effectively

Not sure where to start? Here’s a simple guide on how to review insurance policies like a seasoned pro:

1. Gather All Your Policies

Compile your home, auto, and any other insurance policies. Make note of:

- Coverage limits.

- Deductibles.

- Premium amounts.

- Expiration dates.

2. Assess Your Current Risks

Ask yourself:

- Have I made changes to my home or car?

- Do I live in an area prone to floods, fires, or other natural disasters?

- Have my driving habits changed (e.g., less commuting or more road trips)?

- Do I use my personal vehicle to run work errands?

- Do I host gatherings in my home?

- Have I purchased expensive electronics, appliances, security systems, etc.?

3. Consult an Independent Insurance Agent

Consulting an independent insurance agent can be one of the most effective ways to ensure your coverage is comprehensive and tailored to your needs. Unlike agents tied to a single carrier, independent agents have access to a wide range of policies from multiple insurers, allowing them to compare options and find the best coverage at the most competitive rates.

Their expertise helps identify potential gaps in your current policy, ensuring that no risk goes uncovered. With their knowledge, you can make better informed decisions and potentially save money on premiums while ensuring strong protection.

Seasonal Insurance Updates: Key Adjustments to Make

Home Insurance

- Winter: Make sure your policy covers snow damage or frozen pipes, two things you definitely don’t want to deal with when it’s cold!

- Summer: If you’ve got a pool, shed, or other outdoor structures, it’s worth making sure they’re covered. And if you live in a wildfire-prone area, adding wildfire insurance can bring peace of mind.

Auto Insurance

- Spring and Fall: If you store seasonal vehicles like motorcycles or RVs, it’s smart to adjust your coverage.

- Winter: Make sure your policy has comprehensive coverage for things like collisions with animals or accidents on icy roads.

Umbrella Policies

If you often host guests or have valuable assets, an umbrella policy offers extra liability protection. It’s a small step that can really make a difference in protecting what matters most.

Benefits of Reviewing Your Insurance Annually

- Stay Ahead of Inflation – As the cost to repair or rebuild homes and vehicles increases, your coverage limits should keep up. Reviewing your insurance regularly helps ensure you’re not underinsured if the unexpected happens.

- Adapt to Technology Changes – New tech, like smart home devices or telematics in cars, can impact your premiums or require updates to your coverage. Staying on top of these changes can keep your insurance in sync with your lifestyle.

- Maximize Discounts – Insurance companies often update their discount programs. An annual review gives you the perfect chance to ask your agent about any new ways you could save on your coverage.

Take Action: Your Coverage Review Starts Today

Don’t wait for a storm, accident, or life event to discover a gap in your coverage. By understanding how to review insurance policies, scheduling regular updates, and focusing on seasonal insurance updates, you’ll protect what matters most.

Need expert help? Our team specializes in personalized insurance services to keep you ready for any season or situation. Contact a YourPolicy agent today by filling out an online contact form or call (866) 236-0203 for a free policy check-up.

Currently Our Locations are Proudly Serviced in These Areas

Texas (Austin, Friendswood, Richardson, Bastrop, Sugar Land, Spring), Massachusetts (Worcester), Michigan (Belgrade), Louisiana (Baton Rouge), Montana (Billings, Belgrade), Oregon (Silverton), Washington (Des Moines, Spokane, White Salmon), North Dakota (Williston), Colorado (Brighton), Virginia (Forest), and Kentucky (Louisville).

Whether you’re in need of personal, business, or specialized insurance solutions, our experts are here to help.

Wherever you live, we are licensed to issue policies nationwide. Contact us today!